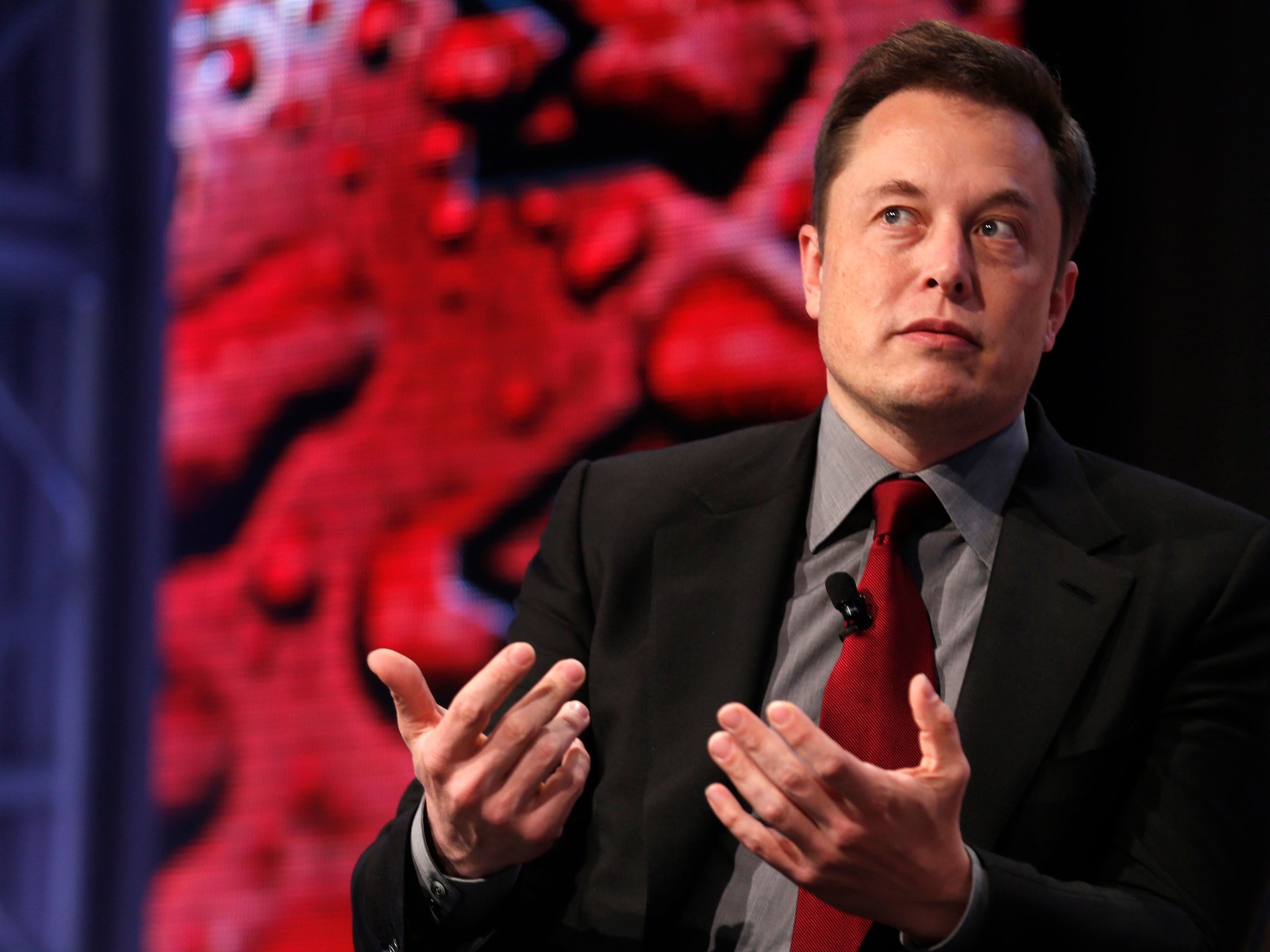

Elon Musk: “...If we need to, we will in-source it (the car insurance)...”

Previously we’ve ended up with the question whether insurance companies are prepared for the disappearance of car insurance. Well...

Elon Musk made a rather harsh utterance.

In Hungary car insurance made around 50% of non-life insurance related premiums in 2017. This is a pretty high number.

But where does it disappear? The right question is rather what it’s transformed into?

There’re the well-rehearsed, tired old arguments about self-driving cars. The moment will arrive when self-driving reaches a status when no intervention at all would be required from our side. Here a car crash will be the sole responsibility of the producer, not that of the “driver”. Still most probably – and to tell the truth correctly – the legislator will require the owner of the vehicle to take out third party liability insurance policy.

But if these vehicles really drive themselves, the current tariffs need to be reconsidered. For example, what will then the age of the “driver” have to do with the extent of the risk? Nothing.

The question is rather about how trustworthy the manufacturer is. Most probably manufacturers will compete in the level of safety: whose car is the safest, where the least accidents happen, or whom the lowest risk factor belongs to. Or maybe in the end manufacturers themselves will push the premiums down for marketing reasons? Because, if you will, the premium is nothing else, but a direct indicator showing the quality and the safety of the car produced. These dynamics are completely different from the existing ones. Nowadays the majority of the risk premium is channelled to motor vehicle workshops; this is a completely different interest...

Some co-operations have already started in which the car manufacturer selects an insurance company and the insurance premium is practically integrated to the price of the vehicle. Currently this solution is planned for comprehensive (Casco) insurance only, but with the expansion of self-driving it will also be true for third party liability car insurance as well.

Elon Musk said: “...If we find that the insurance providers are not matching the insurance proportionate to the risk of the car, then if we need to, we will in-source it...” He also explained that he imagines car insurance to be integrated into the price of the vehicle.

In a tweet Elon stated the following: “...Insurance premiums expected to decline by 80% due to driverless cars...”

There’re significantly less car manufacturers than insurance companies. Thus, insurance companies wanting to be competitive on this market need to position themselves well and quickly. Even now there’s a great rush around the manufacturers, for a reason of course.

Car insurances might turn to a dozen of B2B contracts from the current millions of retail ones. Completely new tariffs need to be developed, and these won’t be about either the drivers or the cars, but merely the producers. Unless insurance companies take the necessary measures, they’ll become completely invisible – and the chances are really high to this. They’ll be like BOSCH or Continental; suppliers. There’re not too many BOSCH logos visible on Audis or BMWs – even though the majority of them were manufactured at a BOSCH plant..

The other big trend nowadays is about car sharing, that is community car share. There’s an increasing number of people opting for community solutions. This is an extremely convenient solution for various reasons, especially in cities. One only uses the car if needed, otherwise it doesn’t cause any headache. Now we’ve reached the situation when community car sharing is estimated to become a 16.5 bn business by 2024. Car2go, the biggest player in the market, has 2.5 millions of registered users and 14 thousand vehicles. It’s also become a B2B business.

These changes will influence both the structure and the revenues of insurance companies. Premiums won’t be that high and the related administration will also be less. There’ll be no need to fiddle with contracts, register them to the system, send out the insurance policy...

The procedure of claim settlement will also change. When thinking about the insurances integrated to the price by car manufacturers, then they will function rather like a guarantee. Should there be a problem, the vehicle goes to the authorized repair workshop – most probably at night and by itself. Here almost no management will be required broken down to individual claims. The frequency of claims will also significantly decrease, pushing down the administration costs alongside with the premium.

There’ve been several composite companies believing that by providing car insurance they can approach the clients with other services as well. But what if there’ll be no client related data available for the insurance companies in this new world?

Profitability will also completely change. The effect thereof will mostly be experienced at subsidiaries. If these contracts are concluded, they’ll be managed as central B2B ones. Part of the premiums written deriving from car insurances will be channelled from the subsidiaries to the headquarters.

Now it seems that in the long term – or even in mid-term – it’s not worthy for an insurance company sacrificing the profitability of its car insurance business in order to acquire more clients. In the long run insurance companies can select from the following options: they either stand behind a car manufacturer as sort of a supplier, or they indeed reach the clients directly. But these clients WON’T be reached through car insurance.

The how will embody a completely new chapter in insurance industry...

Next:

DIGITAL TRANSFORMATION IS A MYTH...

A bejegyzés trackback címe:

Kommentek:

A hozzászólások a vonatkozó jogszabályok értelmében felhasználói tartalomnak minősülnek, értük a szolgáltatás technikai üzemeltetője semmilyen felelősséget nem vállal, azokat nem ellenőrzi. Kifogás esetén forduljon a blog szerkesztőjéhez. Részletek a Felhasználási feltételekben és az adatvédelmi tájékoztatóban.