In the insurance industry there’s not a single professional conference without at least one panel discussion on the world of insurtech. This is the area, where efficacy is tried to be improved by the application of new technologies; still, there’re quite many things mixed up in this topic: the big players’ fear of change, of losing their current position, as well as the unrestrained self-confidence of the start-up generation, for whom constraint and limitation are unknown phenomena

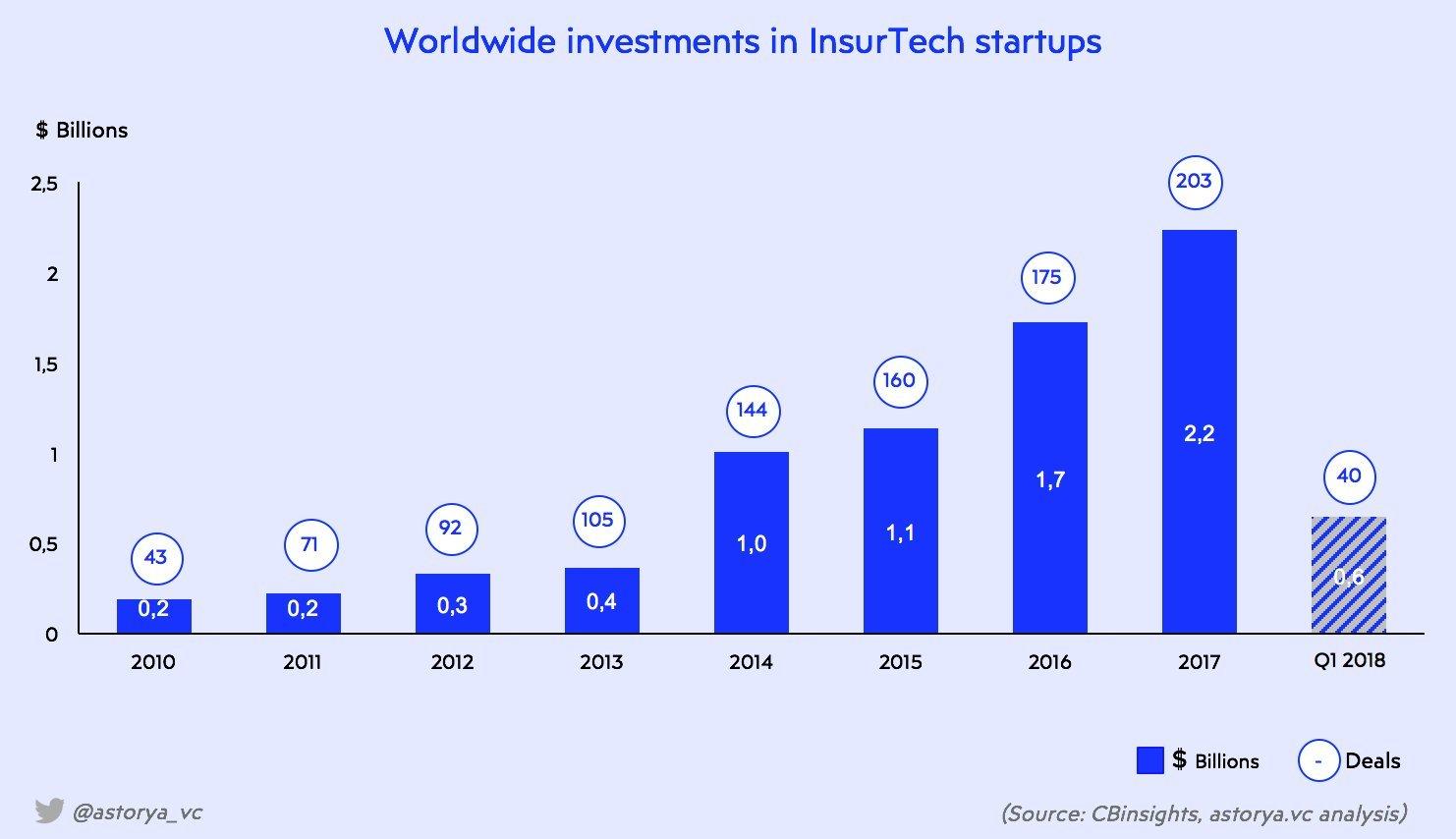

For this reason, it’s worth taking a step back and having a look at what is happening here in reality. Since 2012 more than USD 8 billion has been invested in various insurtech ideas all around the world; in 2017 alone, there were more than 200 closed transactions in the course of which more than USD 2 billion has been invested. But in fact, what are these ideas?

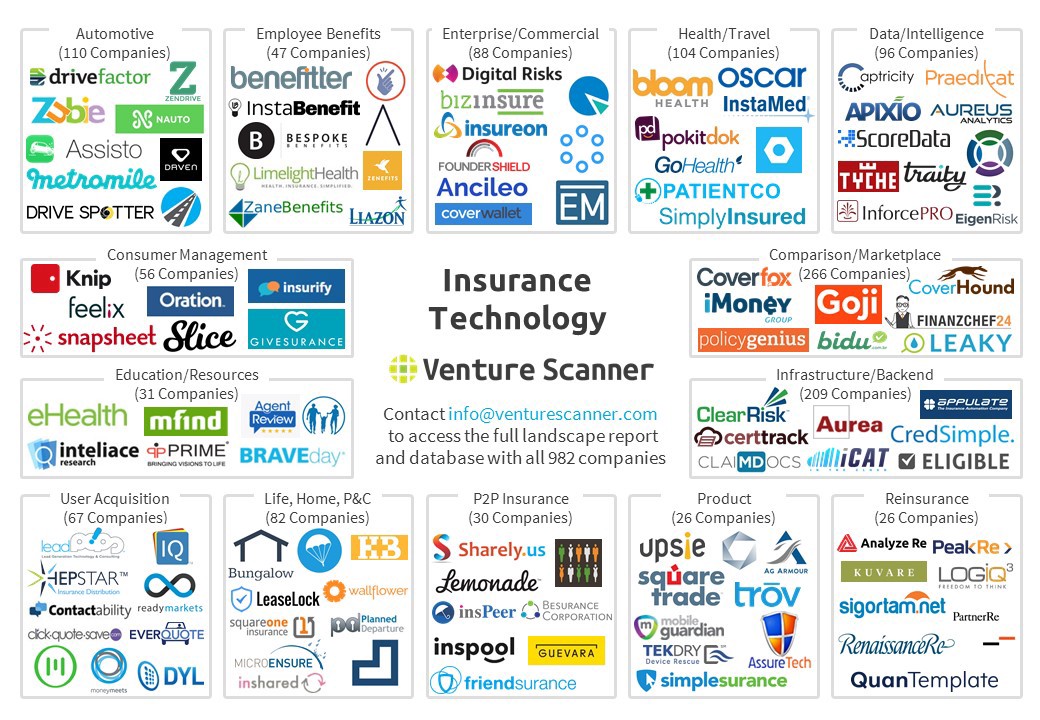

The majority of them try to rethink the sales part of insurance. A great proportion of these ideas target products that serve niche demands, though very big volumes are required for the model to operate. The Chinese enterprise, Zhong An is a good example for this; they identify themselves as the first complete Chinese online insurance company. But is it indeed an insurtech start-up or rather a good idea, which can earn some money by using the huge database of Alibaba? The right answer is most probably the second one.

Of course, there’re also some that rethink the complete value chain, from product to claim settlement. Lemonade is a good example for this; they turn the traditional model upside down. Still, return remains to be a huge question even here.

These are indeed new solutions, but the question arises: why has so much money arrived at this area? It’s strange to say so, but in my opinion simply for the lack of better ideas. There’s lot of money to be invested and this is an easy-to-market, easy-to-sell story, as we’re now speaking about one of the last billion-dollar service businesses operating on a traditional basis; a business, which is up for renewal.

“Only” IT, a good team, some creativity and a little bit of expertise are required as a start. Those recently trying to get money for ideas like this, could be surprised to find how simple it is nowadays, even up to a million euros.

So, the slogan is there: let’s invest into the Facebook of the insurance industry. Investment funds, as usual, follow the trends; however, the crux of the matter is that it’s not clear, how the money spent could result in a return.

The first couple of major investments were executed approximately 5 years ago, meaning that these innovative companies should realize their promises pretty soon. Of course, one might say that clients shall be made familiar with the new solutions even more, and for this more money and time will be necessary; but these investments were not put into an excel sheet to be written off later.

In spite of all these seemingly pessimistic lines I do believe that in the coming 3-5 years insurance industry will change; still, for the time being it seems that these start-ups will rather act as indicators, not as solutions of the changes. The insurtech world might become Prince Charming, whose kiss awakens Sleeping Beauty, and that will be the time of a real change.

And what does that mean in practice? I call the model working with the current non-life insurance services “Rule 50-15-20-15”. These figures show how much is spent on various elements from an insurance premium of EUR 100. 50 percent is spent on claims settlement services, 15 on the administration costs, 20 is the cost of client acquisition, whereas 15 percent is spent on tax and regulatory expenses. Real change can only be conceivable in the sector if this rule is modified, and success will most probably be achieved if the majority of these elements change simultaneously. If taking a look at some already reformed industries, it can be drawn as a conclusion, that basic functions, like the ones above, have changed.

In the case of Uber, for example, the dispatcher was taken out of the chain, thus the related costs do not incur any longer, and, as a result of the technological change, the service is almost infinitely scalable, independently of national boundaries. As a consequence thereof, customer experience has changed drastically, similarly to the cost structure, meaning that customers get more at lower costs.

The same can be achieved in the insurance business as well. The 15 percent tax and regulatory cost can be considered as fix, but the modification of all other elements is just a matter of the model applied. The 15 percent administration cost could be reduced, the number of products is well defined, and in many countries they could be marketed through a single centre without any major change.

The current insurance companies won’t be able to switch to this organizational structure in the coming 3-5 years because of local interests, their product structure and the diversity of the already existing portfolios. Although such company might be established as a greenfield investment project, in that case the portfolio building costs will be high, since the 20 percent customer acquisition cost is a tender spot in the model. Demands are different in every age group; there are some, who need personal contact, whereas under the age of 35 it seems there’s no more need for that. But nowadays the majority of the premium is paid by the 35+ age group.

I’m confident that my 50-15-20-15 rule won’t exist in its current form in 5-8 years from now, but there’s a good chance that the change will be generated by those players of the insurance industry who will be awakened from their “Sleeping Beauty sleep”.

A bejegyzés trackback címe:

Kommentek:

A hozzászólások a vonatkozó jogszabályok értelmében felhasználói tartalomnak minősülnek, értük a szolgáltatás technikai üzemeltetője semmilyen felelősséget nem vállal, azokat nem ellenőrzi. Kifogás esetén forduljon a blog szerkesztőjéhez. Részletek a Felhasználási feltételekben és az adatvédelmi tájékoztatóban.